Identify AML risks before they harm your business

Practical Financial Software You Can Count On

Detect high-risk users by screening them against global watchlists for sanctions, PEPs, and adverse media. All this is done automatically with our AI-powered AML Screening and Ongoing Monitoring solution

Secure your business with AML screening

What We do

Protect your business from financial crime and fraudsters. This is important for ensuring compliance with international regulations, preventing money laundering, and mitigating the risk of financial crimes. By identifying high-risk individuals and entities, businesses can avoid legal repercussions and protect their reputations.

01. Sanctions Compliance

Identify and limit individuals listed on sanctions and watchlists.

Screen your customers against global watchlists and sanctions lists, including OFAC, UN, HMT, EU, DFAT and many more

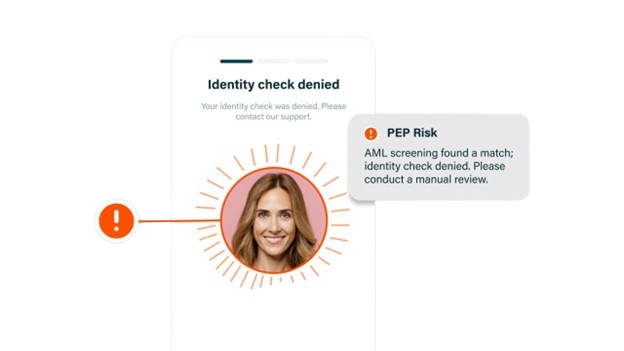

02. Politically Exposed Persons (PEP)

Screen Clients and Partners for Political Exposure

Conduct both onboarding and ongoing monitoring for your users and get notified about any indicators for political exposure.

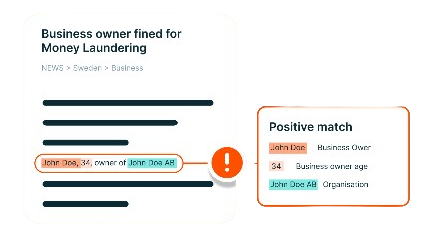

03. Adverse Media Checks

Analyze adverse media

We monitor a multitude of media sources for any negative mentions and compile this data into customer profiles for seamless review.

How does AML screening work?

The software uses advanced algorithms to scan and match individuals or entities against comprehensive databases of PEPs and sanctioned parties. The software continuously updates its lists from reliable sources such as government agencies, international organisations, and financial regulators. When a match is found, the software provides detailed reports, enabling you to assess the risk and take appropriate action.

Identity Verification

Sanction and PEP List Checks

Adverse Media Screening